WISDOM FROM Rich Dad Poor Dad

(Lessons from the book by Robert Kiyosaki)

The wisdom shared in Rich Dad Poor Dad is timeless and powerful, offering a fresh perspective on money, wealth, and financial freedom. Let’s dive into some key lessons from this groundbreaking book, with added insights to inspire your financial journey.

1. Don’t Work for Money – Make Money Work for You

The rich don’t work for money; they make their money work for them.

If you spend your life working for money, you’ll think like an employee, always chasing a paycheck. Shift your mindset to think like a wealthy person. Every dollar you invest in your asset column becomes an employee working for you.

Remember: building wealth isn’t about how much you earn; it’s about how much you grow.

2. Don’t Be Controlled by Emotions

Fear and greed are the two emotions that control most people when it comes to money.

- Fear keeps people stuck in the “work hard, earn money” cycle, hoping their fears about finances will go away.

- Greed pushes people into risky decisions or shortcuts to wealth without proper financial education.

Instead of being ruled by these emotions, educate yourself. Build a strong financial foundation so fear and greed won’t dictate your choices.

3. Acquire Assets, Not Liabilities

One of the simplest, yet most misunderstood, lessons is this: Buy assets, not liabilities.

- Assets: Things that put money in your pocket (like stocks, rental properties, or businesses).

- Liabilities: Things that take money out of your pocket (like cars, personal loans, or houses you live in).

The wealthy focus on acquiring assets first, letting those assets fund their luxuries. The poor and middle class often buy luxuries first, mistaking them for assets.

For example, a house you live in is not an asset unless it generates income, such as by renting it out. Always ask yourself: is this purchase putting money in my pocket or taking it out?

4. Keep It Simple and Smart (KISS Principle)

Financial freedom doesn’t have to be overly complicated.

- The core principle is this: Assets add money, liabilities subtract money.

- Focus on consistently building your asset column while keeping your liabilities in check.

Don’t let overthinking or unnecessary complexity stop you from taking action. Start small, but start smart.

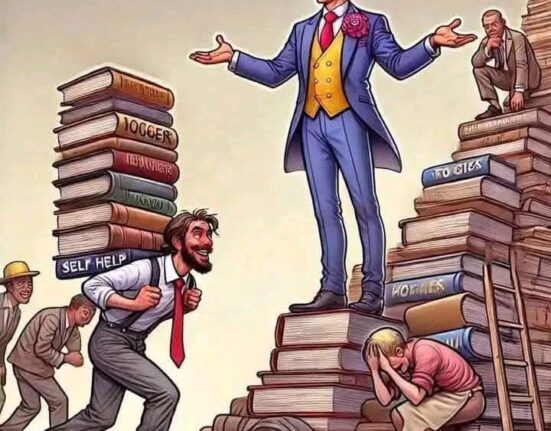

5. Don’t Be Financially Illiterate

Financial literacy is not taught in most schools, but it’s critical for a stable future.

You might be highly educated or successful in your profession, but without financial education, your wealth can crumble. Learn about money, investing, and wealth creation. Start by reading books like Rich Dad Poor Dad, and surround yourself with financially savvy individuals.

6. Wealth is About Time, Not Money

Wealth is not how much money you earn—it’s how long you can survive without working.

Ask yourself:

- If I stopped working today, how many days, months, or years could I sustain my lifestyle?

True wealth is about creating passive income streams that keep you afloat, even when you’re not actively working.

7. Mind Your Own Business

If you have a job, that’s great—but don’t stop there. Use your spare time wisely to build something of your own.

- Start a side business.

- Build passive income streams.

- Use the time you spend scrolling social media or partying to work on your dreams.

Never quit your job until your business is sustainable, but don’t spend your life working solely to grow someone else’s empire.

8. Your Mind is Your Biggest Asset

Most people look for opportunities with their eyes, but wealthy people find opportunities with their minds.

- Train your mind to think creatively and spot opportunities others miss.

- Educate yourself constantly to expand your perspective and ability to innovate.

Your mind has the potential to generate enormous wealth—if you nurture it.

9. Learn the Technical Skills of Wealth Creation

To grow your financial IQ, focus on mastering four key areas:

- Accounting: Learn to read financial statements and understand the numbers.

- Investing: Develop the science of making money work for you.

- Understanding Markets: Study the basics of supply, demand, and market trends.

- The Law: Understand tax advantages and how to leverage corporations to build wealth.

Each of these skills builds the foundation for creating and sustaining wealth.

10. Spot Opportunities That Others Miss

“Great opportunities are not seen with your eyes; they are seen with your mind.”

Train your mind to think critically and creatively. Opportunities are everywhere, but they require a mindset that sees possibilities instead of obstacles. This isn’t rocket science—it’s about awareness and preparation.

11. Learn to Manage Risk, Not Avoid It

Many people think investments are risky. The truth is, not knowing what you’re doing is risky.

- Educate yourself to reduce risk.

- Sit with mentors or people experienced in investing.

- Read books and learn from others’ successes and failures.

The more knowledge you have, the more confident and strategic you’ll become.

12. Master Key Management Skills

To grow wealth, you must learn to manage three critical areas:

- Cash Flow: Know how much money is coming in and going out.

- Systems: Build systems that automate and scale your financial strategies.

- People: Leadership and communication skills are vital to managing teams and relationships effectively.

Additionally, sales and marketing skills are essential. Whether you’re selling a product, idea, or vision, effective communication is the backbone of success.

13. Overcome Fear of Failure

“Failure inspires winners. Failure defeats losers.”

Everyone fears losing money, but failure is a part of the journey. Each mistake brings valuable lessons. Winners embrace failure as an opportunity to grow, while losers let it stop them in their tracks.

Courage isn’t about the absence of fear; it’s about moving forward despite it.

14. The Journey is Yours—Own It

Financial freedom is a journey, not a destination. Start small, stay consistent, and keep learning. The principles from Rich Dad Poor Dad are not just for the wealthy—they’re for anyone willing to take control of their financial future.

Empower yourself, take risks, and build a life that reflects your dreams. The opportunities are out there—you just need to seize them.

Leave feedback about this